Signet Jewelers to Close Stores, Cut Staff Amid Declining Sales

The moves are part of the retailer’s new turnaround plan, “Grow Brand Love,” which also includes emphasizing brand loyalty over store banners.

New CEO J.K. Symancyk laid out the jewelry giant’s plans during its earnings call Wednesday morning, which include a new turnaround plan that encompasses leadership changes, store closures and renovations, and a focus on brand loyalty.

The new plan, titled “Grow Brand Love,” was created in response to the company’s “lack of growth,” he said.

It will focus on “creating a clear distinction between brands to attract new and loyal customers that see themselves reflected in the DNA of each brand,” said Symancyk.

Historically, Signet has referred to the store chains in its portfolio as “banners,” but Symancyk wants to change how they’re perceived by consumers.

“Brands build loyalty with customers through emotional and engaging connections, while banners are transactional, literally a static nameplate on the door,” Symancyk said.

Its three largest brands, Kay, Zales, and Jared, have high consumer awareness, he said, but growth has been “elusive” so the company will work on building brand loyalty.

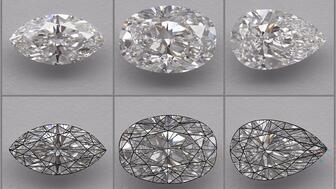

The company plans to add more design-focused jewelry into its assortment to promote gifting and self-purchasing while also expanding its position in the bridal market, which has been struggling in the wake of the COVID-19 pandemic.

The strategy will require a reorganization, including reducing the ranks of its senior leadership by 30 percent, he said.

The company also said Wednesday that it will be evaluating 150 underperforming stores, primarily in malls, over the next two years and decide whether they should be closed or improved.

There are also plans to renovate 200 locations and possibly relocate another 200.

“Nearly 200 doors in our fleet have healthy performances but are in venues that we believe are in decline,” Signet Chief Financial, Strategy and Services Officer Joan Hilson said. “Over the next two to three years, we plan to reposition many of these stores to off-mall locations.”

This means that 550 stores, or roughly a quarter of Signet’s fleet, are up for closure, renovation, or relocation.

For the quarter ended Feb. 1, Signet’s overall sales totaled $2.35 billion, down 6 percent year-over-year and below its expectations.

Same-store sales slipped 1 percent.

For the full year, sales totaled $6.7 billion, down 7 percent year-over-year and also falling short of expectations.

Same-store sales fell 3 percent.

The bridal market has been struggling since the COVID-19 pandemic, weighing on its sales, but Hilson said the “engagement recovery” is continuing.

Symancyk said the company plans to grow its share in the bridal category (currently around 30 percent) through “assortment and price-point architecture,” leveraging its in-house design capabilities, adding modern designs, and working with its vendor partners.

As for fashion jewelry, he said the company may be able to increase its market share through gifting for milestones and other special occasions as well as self-purchasers.

The retailer also has plans to consolidate its repair services.

Signet provided an update on its holiday season sales in January, noting its performance fell below expectations, with same-store sales down, particularly in the days leading up to Christmas.

The company pointed to poor sales of fashion jewelry as the culprit, noting that consumers were looking for deals and it did not have enough lower-priced jewelry to meet their needs.

“We will continue to make changes to our assortment this spring to drive improvement for the next two major gifting seasons, Mother’s Day and the winter holidays,” Symancyk said.

In North America, Signet’s banners include Zales, Jared, and Kay Jewelers, as well as Peoples in Canada.

Signet’s fourth-quarter sales in the region totaled $2.22 billion, down 6 percent year-over-year, while same-store sales in the region were down 1 percent.

For the full year, sales in North America totaled $6.3 billion, down 6 percent year-over-year with same- store sales declining 4 percent.

Signet’s international banners include U.K. stores Ernest Jones and H. Samuel.

International quarterly sales totaled $126.2 million, falling 11 percent year-over-year, with same-store sales down 2 percent.

For the full year, international sales totaled $372.3 million, tumbling 13 percent with same-store sales down 1 percent.

Signet expects first-quarter sales to total between $1.5 and $1.53 billion, with same-store sales flat to up 2 percent.

For the full year, the company forecasts sales of $6.53 to $6.8 billion, with same-store sales down 3 percent to up 2 percent.

The Latest

The heist happened in Lebec, California, in 2022 when a Brinks truck was transporting goods from one show in California to another.

The 10-carat fancy purple-pink diamond with potential links to Marie Antoinette headlined the white-glove jewelry auction this week.

The Starboard Cruises SVP discusses who is shopping for jewelry on ships, how much they’re spending, and why brands should get on board.

The Seymour & Evelyn Holtzman Bench Scholarship from Jewelers of America returns for a second year.

The historic signet ring exceeded its estimate at Noonans Mayfair’s jewelry auction this week.

To mark the milestone, the brand is introducing new non-bridal fine jewelry designs for the first time in two decades.

The gemstone is the third most valuable ruby to come out of the Montepuez mine, Gemfields said.

The countdown is on for the JCK Las Vegas Show and JA is pulling out all the stops.

Founder and longtime CEO Ben Smithee will stay with the agency, transitioning into the role of founding partner and strategic advisor.

Associate Editor Natalie Francisco shares 20 of her favorite pieces from the jewelry collections that debuted at Couture.

If you want to attract good salespeople and generate a stream of “sleeping money” for your jewelry store, then you are going to have to pay.

The top lot was a colorless Graff diamond, followed by a Burmese ruby necklace by Marcus & Co.

Gizzi, who has been in the industry since 2001, is now Jewelers of America’s senior vice president of corporate affairs.

Luca de Meo, a 30-year veteran of the auto industry, will succeed longtime CEO François-Henri Pinault.

Following visits to Vegas and New York, Botswana’s minerals minister sat down with Michelle Graff to discuss the state of the diamond market.

The “Your Love Has the Perfect Ring” campaign showcases the strength of love and need for inclusivity and representation, the jeweler said.

The former De Beers executive is the jewelry house’s new director of high jewelry for the Americas.

The New York Liberty forward is the first athlete to represent the Brooklyn-based jewelry brand.

Take a bite out of the 14-karat yellow gold “Fruits of Love Pear” earrings featuring peridots, diamond stems, and tsavorite leaves.

The one-day virtual event will feature speakers from De Beers, GIA, and Gemworld International.

The California-based creative talks jewelry photography in the modern era and tackles FAQs about working with a pro for the first time.

Al Capone’s pocket watch also found a buyer, though it went for less than half of what it did at auction four years ago.

The foundation has also expanded its “Stronger Together” initiative with Jewelers for Children.

Assimon is the auction house’s new chief commercial officer.

The De Beers Group CEO discusses the company’s new “beacon” program, the likelihood diamonds will be exempt from tariffs, and “Origin.”

The Danish jewelry giant hosted its grand opening last weekend, complete with a Pandora pink roulette wheel.

Industry veteran Anoop Mehta is the new chairman and independent director of the IGI board.